Right here's Why You Need to Have Penny Stocks in Your Investment Profile Today

If you're looking to boost your investment portfolio, penny stocks can be a crucial element. Allow's explore what makes penny stocks a fascinating choice for smart investors.

Understanding Penny Stocks: What They Are and Exactly How They Function

Dime stocks, typically seen as high-risk investments, are shares of little business that trade at small cost, typically under 5 bucks. These supplies can be luring because of their low access obstacle, enabling you to buy in without a hefty financial investment. Nonetheless, the lower cost usually mirrors the company's limited monetary stability or market presence.

When taking into consideration penny stocks, it's crucial to understand the aspects driving their costs - penny stocks. They commonly lack liquidity, making it challenging to offer your shares at a desirable time. Additionally, the info readily available concerning these business is commonly sporadic, increasing your financial investment danger

Before diving in, do detailed research study on the firm's fundamentals and market conditions. It is very important to identify that while the potential for loss is substantial, the knowledge you obtain can form your financial investment strategy. Stabilizing danger with educated decision-making is crucial to guiding through the world of penny stocks.

The Possible for High Returns: Why Penny Stocks Bring In Capitalists

Numerous capitalists are drawn to the appeal of penny stocks as a result of their possibility for significant returns. With rates frequently ranging from just a couple of cents to a pair of bucks, even a small increase in value can result in outstanding percentage gains. Visualize getting shares at 50 cents and seeing them rise to $2; that's a 300% return!

This enticing growth possible attract those aiming to make substantial revenues without an enormous preliminary financial investment - penny stocks. In addition, arising firms commonly start as penny stocks before gaining traction, providing a special opportunity to enter at an early stage future successes

While they feature greater threats, the chance to take advantage of rapid development maintains investors interested. If you're prepared to do your research study and stay informed, penny stocks might provide the high returns you've been looking for in your investment portfolio. Welcoming this possibility may just be the trick to improving your total returns.

Diversity: Mitigating Danger With Dime Supply Investments

When you purchase penny stocks, you're touching right into a low-priced entry technique that allows you to spread your resources across numerous firms. This diversity assists mitigate threat while still giving you access to the high-growth prospective these supplies can supply. Balancing your profile with penny stocks can bring about exciting opportunities without overexposing yourself to any type of solitary investment.

Low-priced Access Method

:max_bytes(150000):strip_icc()/investing-in-the-future-157295701-5a5b95325b6e2400388c7e5e.jpg)

High-Growth Prospective

Discovering penny stocks opens the door to high-growth possibility, specifically when you purposefully expand your financial investments. By assigning a section of your portfolio to these low-priced supplies, you can take advantage of arising business that might experience considerable development. This diversity not only enhances your opportunities of locating a winning stock however likewise assists alleviate dangers connected with larger, a lot more volatile financial investments. Bear in mind, while penny stocks can produce impressive returns, they likewise include fundamental risks. Stabilizing these investments with more stable properties can provide a safety web. As you explore numerous penny stocks, watch on market trends and firm fundamentals to make informed decisions that align with your financial goals. Accept the potential and grow your portfolio wisely!

Identifying Opportunities: How to Discover Promising Penny Stocks

Following, evaluate trading quantity. Enhanced volume can show heightened rate of interest and potential rate movement. Examine for current information or news release-- favorable developments can boost supply efficiency. Usage supply screeners to filter penny stocks meeting your criteria, such as market capitalization or profits development.

Finally, trust your reactions. If something feels off or too great to be real, dig deeper. By staying educated and vigilant, you can uncover chances that others may overlook, making penny stocks an important addition to your financial investment portfolio.

The Function of Research: Due Persistance Before Investing

When you're considering penny stocks, research study is important to making notified decisions. Examining monetary declarations aids you evaluate a firm's health, while recognizing market fads can reveal prospective development opportunities. Without this due diligence, you might miss out on out on essential understandings that can influence your investments.

Analyzing Financial Statements

Analyzing financial declarations is necessary for making educated choices concerning penny stocks. A strong equilibrium sheet with workable debt can signify stability, while consistent revenue development shows potential for growth. Remember, comprehensive evaluation equips you with the understanding to make wise investments in the volatile cent supply market.

Understanding Market Patterns

What elements form the market trends for penny stocks? Financial signs, industry news, and firm growths can all impact cent stock efficiency.

Conduct detailed research to determine potential stimulants, like product launches or adjustments in leadership, that might affect link a penny supply's trajectory. Don't ignore technical analysis as well; taking a look at rate patterns can help you identify entrance and leave points.

Last but not least, recognize market volatility-- penny stocks can vary significantly. By doing your due diligence and remaining updated, you'll place yourself to make educated choices, ultimately optimizing your financial investment profile's capacity.

Common False Impressions Regarding Penny Stocks

Several capitalists think that penny stocks are absolutely nothing more than high-risk gambles, yet this misconception neglects their possibility for considerable gains. While it holds true that these stocks can be unstable, they additionally use possibilities for significant returns that even more well established supplies may not. You may think that penny stocks do not have reputation, but numerous credible companies begin as small-cap supplies before becoming larger entities.

Another usual myth is that penny stocks are just for unskilled investors. In truth, savvy investors often make use of penny stocks as a tactical method to expand their profiles. You might likewise think that trading them is complex, yet with the right tools and sources, you can browse these markets successfully. Inevitably, don't be fooled right into believing that all penny stocks are scams; detailed research can disclose encouraging firms with solid principles. Welcome the potential and start exploring what penny stocks can provide you!

Tips for Effective Cent Stock Trading Methods

While link diving right into the world of penny stocks can be daunting, using efficient trading approaches can considerably improve your possibilities of success. Research the firms behind the supplies and maintain an eye on their monetary health and wellness and market trends.

It's also vital to stay updated with market information and financial indicators, as these can meaningfully impact cent stock rates. Cent supplies can be unpredictable, and short-term variations may tempt you to sell as well early. Stick to your plan, and you'll boost your opportunities of enjoying the benefits from your dime stock financial investments.

Frequently Asked Inquiries

What Are the Typical Trading Hours for Penny Stocks?

Dime supplies commonly trade throughout routine market hours, which are 9:30 AM to 4 PM EST on weekdays. Realize, though, that some stocks might likewise have pre-market or after-hours trading alternatives readily available.

Are Penny Stocks Readily Available on All Supply Exchanges?

Penny supplies aren't offered on all stock exchanges. You'll generally discover them on smaller exchanges like the OTC Markets, while bigger exchanges like the NYSE or NASDAQ generally listing stocks with greater minimum rate needs.

Can I Invest in Penny Stocks With a Little Spending Plan?

How Do Taxes Put On Cent Supply Gains?

When you offer penny stocks for a revenue, you'll require to report those gains on your taxes. Short-term gains are taxed at your ordinary income rate, while lasting gains may get approved for reduced prices.

What Are Some Red Flags to See for in Penny Stocks?

When considering penny stocks, expect reduced trading volumes, regular promos, and abrupt rate spikes. Additionally, beware of companies doing not have transparency or those with dubious financials. These red flags might indicate possible threats in your investment.

Devin Ratray Then & Now!

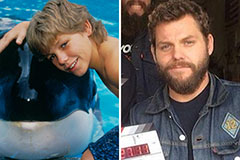

Devin Ratray Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!